Track Credit Card Application Status Online

Loading your search...

Tracking the status of your credit card application is an easy and user-friendly process. However, the process varies for different banks. The simplest and most direct way for checking the application status is on the bank’s website using your application number or mobile number. Customer service options are also available in many banks for providing assiatance. Read on to know the various methods by which you can check the status of your application.

Documents required to check your credit card status

You must keep the following documents ready for easy verification and quick assistance to check the status of your application:

- Application Number

- PAN Card number

- Form number

- Date of birth

General Steps to Track Your Credit Card Application Online

You must follow the steps given below in order to track your application status:

Step 1: Visit the bank's official website

Step 2: Click on 'Track application'

Step 3: By clicking on application status, you will be displayed a window prompting you to enter details such as application form, PAN number, etc.

Step 4: Once all details are entered, click on the status or enter the tab

Step 5: The website will display the status of your credit card application form

Step 6: Alternatively, you can call the bank branch or visit the bank to check the status of your credit card application.

How to Check BankBazaar Credit Card Application Status

BankBazaar provides an option to apply for a credit card online. You can choose from a broad range of credit cards offered by various banks. You can use BankBazaar's website to compare the features of the cards including rewards, joining perks, fees, and various other details. Based on the information provided by you, you can also check for eligibility for a credit card. From rewards cards to airline miles cards and more, you can find a broad range of credit card offers.

The credit card application services are provided on the website as well as on the BankBazaar app. The BankBazaar app is available for Android and iOS mobile phones. The app also lets you compare and apply for various types of financial products and services. The website and app will assist you in keeping a track of the status of your application.

Once you have submitted your application, you can follow these steps to check the application status:

- Step 1: Visit - Track Your Credit Card Application Status

- Step 2: Or open the app and select 'Track Application'

- Step 3: Enter your credit card application ID and mobile number

- Step 4: Click 'Track Application'

By following these steps, you will be able to view the status of your application instantly. The page will also provide you with important information related to your credit card.

Steps to Check Credit Card Application Status Offline

If you are someone who is not comfortable in online methods of checking the status, you can also check your credit card application status offline. Here are some common ways:

- Through Customer Care:

- Call the customer care number of the issuing bank or NBFC.

- The support representative will request your application or reference number and provide the application status.

- Some NBFCs or banks also offer dedicated customer care lines for credit card inquiries.

- By Visiting the Branch:

- Visit the nearest bank branch or NBFC branch to check your application status.

- Generally, the helpdesk representative will ask for your application number and registered mobile number.

- Through SMS:

- Some banks provide the option to check application status via SMS.

- Send an SMS in the specified format to the correct number from the mobile number registered with the bank.

- You will receive the application status via SMS.

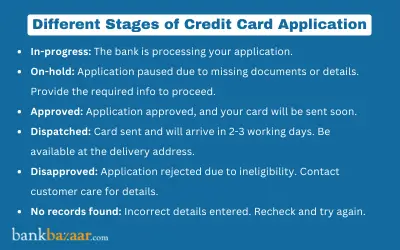

Possible Results for Credit Card Application Status Check

After checking your credit card application status, it's helpful to understand the meaning behind each status update. Here are the possible stages your application might be in:

- In Process: This status indicates that your application is still under review. During this stage, the bank examines your documents and makes a hard inquiry into your credit score. After completing the review, they will decide whether to approve or decline your application.

- Dispatched: If the status shows 'Dispatched', it means your application has been approved, and the bank is sending the credit card to you via post. The card should arrive within three to four business days.

- On Hold: This status appears when required documents are missing or the bank still needs to receive your credit score information from CIBIL or another credit bureau. You may need to contact the bank by phone or email for more information.

- Disapproved: If your application shows as 'Disapproved', the bank has declined your request for a credit card. This may be due to an insufficient credit score or failure to meet eligibility criteria. You can contact the bank for further clarification.

- No Records Found: This status usually results from entering incorrect details, such as an unregistered mobile number or an error in the reference number format. Try reloading the page, carefully re-entering your details, and submitting again.

Track your Credit Card Application Online by Banks

Each bank differs slightly in displaying the same information. Some of them are given below:

SBI Credit Card Application Status

Follow the steps given below to check your SBI Credit Card status online:

- Step 1: Visit https://www.sbicard.com and click on the 'Credit Cards' tab on the navigation bar

- Step 2: Click on sbi status link 'Track Your Application'.

- Step 3: Click on 'Status of your application' and enter the application number.

- Step 4: Alternatively, you can also click on the 'Retrieve Application' tab.

- Step 5: Enter your PAN card number and date of birth as mentioned on the application form.

- Step 6: Click on the Retrieve button to get the SBI Card application status.

IndusInd Bank Credit Card Application Status

If you are an IndusInd Bank Credit Card cardholder, you can check the status of your credit card with the following easy steps:

- Step 1: Visit to Check IndusInd Credit Card Status.

- Step 2: Once you go to the link, all you have to do is enter the application Id and mobile number that you have provided in the application for the credit card.

- Step 3: Once both the fields are entered, the site will display the credit card application status

You can also know the status of your application by calling the helpline number 1860-267-7777.

HSBC Credit Card Application Status

The bank sends timely updates of the application status through SMS on your registered mobile number. However you can also track the status via a very simple process. You can access the details with very easy steps:

- Step 1: Visit the official website of HSBC to track Credit Card Application.

- Step 2: Enter application number.

- Step 3: Full Name and Date of Birth.

- Step 4: Once all the information is provided, the site will display the credit card application status.

Axis Bank Credit Card Application Status

The process to track the status of an Axis Bank Credit Card application is quite straightforward. You can access the details with the steps mentioned below:

- Step 1: Visit the dedicated Axis Bank website.

- Step 2: From the three options on the menu bar, select 'Track Your Application'

- Step 3: You will then be asked to enter the Application ID as well as your mobile number as per the application form.

- Step 4: Enter 'Submit' and you will be able to retrieve the status of your credit card application at Axis Bank.

HDFC Credit Card Application Status

Track HDFC Credit Card status just with the simple steps mentioned below

- Step 1: Visit the official HDFC credit card application tracking page.

- Step 2: Enter your registered mobile number.

- Step 3: Then, enter the 16-digit application number, your form number and date of birth.

- Step 4: Click “Submit” after completing the captcha.

You can also use Net Banking or Mobile App or call on 1800-202-6161.

RBL Credit Card Application Status

To know the status of your RBL Credit Card application, follow the steps given below:

- Step 1: Visit the bank's official website and click on the 'Credit Cards' tab on the homepage

- Step 2: On the right of the page, click on 'To know your Application Status'

- Step 3: Click on 'Proceed', which will take you to another page that says 'Track your online application status'.

- Step 4: Then fill in the 13- digit application reference number and mobile number and click on 'Submit'

- Step 5: The page will display the credit card application status once you click “Submit”.

Standard Chartered Bank Credit Card Application Status

The most ideal way to check your status is to call the bank on (STD CODE) 66014444/ 39404444 using your registered mobile number. However you can also follow the steps given below:

- Step 1: Visit the official Standard Chartered Bank

- Step 2: Search for credit card status.

- Step 3: The status link will be displayed on the screen

- Step 4: The link displays two fields, application reference number and mobile number. Do include # when entering the application reference number

- Step 5: Once both are entered, click on the 'submit' tab and you can track the status of your application form with the bank.

FAQs on Credit Card Application Status

- How will I know if my credit card application has been approved or rejected?

After the bank goes through all the details you have provided, you will receive an email, SMS, or a letter from the bank stating whether or not your application has been approved or rejected. If, however, you don't hear from the bank, you can always use any of the methods mentioned above to track the status of your card.

- Do I need to have a bank account with a particular bank before I apply for a credit card issued by them?

No, you don't need to have a bank account with the bank before you apply for a credit card issued by them.

- What happens if I don't complete my credit card application online?

As long as you have saved the information you previously filled in, you can retrieve the form and fill it in at any time. If, however, the form hasn't been saved, you will have to start filling out the application from the beginning.

- How do I activate my new credit card?

The steps to activate your credit card will vary from one bank to the other. In general, however, you can activate your new credit card by going to the bank's ATM and following the instructions. You can also call the bank's toll-free number or use their internet banking service to activate your credit card.

- How long does it take for a credit card application to get processed?

Generally, a credit card application gets processed in 7 to 10 working days.

- Can housewives apply for credit cards?

Yes, housewives can apply for a credit card. However, they are required to maintain a minimum account balance and show minimum earnings every month.

- Can I apply for multiple credit cards simultaneously?

Yes, you can apply for multiple credit cards simultaneously if you meet the eligibility criteria. However, it is advisable to avoid doing so as it can harm your credit score.

- When can I expect the FinBooster: YES Bank - BankBazaar Co-branded Credit Card to be issued?

The FinBooster: YES Bank - BankBazaar Co-branded Credit Card will be issued by the bank within 30 - 45 days from the date of application.

Types of Credit Card

- Top 10 Credit Cards in India

- Fuel Credit Cards

- Lifetime Free Credit Cards

- Kisan Credit Card

- Student Credit Cards in India

- Shopping Credit Cards

- Contactless Credit Cards

- Travel Credit Cards

- Co-Branded Credit Cards

- Lifestyle Credit Cards

- Rewards Credit Cards

- Business Credit Cards

- NRI Credit Cards

- Cashback Credit Cards

- Lounge Access Credit Cards

Credit Card by Banks

- Axis Bank Credit Card

- HDFC Bank Credit Card

- Kotak Bank Credit Card

- Federal Bank Credit Card

- SBI Credit Cards

- HSBC Credit Card

- IndusInd Bank Credit Card

- RBL Bank Credit Card

- Standard Chartered Credit Card

- YES Bank Credit Card

- Canara Bank Credit Card

- Punjab National Bank Credit Card

- Bank of Baroda Credit Card

- IDBI Credit Card

- Union Bank of India Credit Card

- Bank of India Credit Card

Articles on Credit Card

- How to Check Credit Card Status

- How to Manage Multiple Credit Cards

- Best Credit Card for Poor Credit

- How to get Credit Card without Job

- Credit Card Insurance Benefits

- How to Apply for Lost Credit Card

- Reasons for Credit Card Rejection

- Advantages & Disadvantages of Credit Card

- Difference between Credit Card & Debit Card

Credit Card Customer Care

- SBI Credit Card Customer Care

- HDFC Bank Credit Card Customer Care

- Axis Bank Credit Card Customer Care

- Federal Bank Credit Card Customer Care

- IndusInd Bank Credit Card Customer Care

- PNB Credit Card Customer Care

- RBL Bank Credit Card Customer Care

- Kotak Credit Card Customer Care

- Yes Bank Credit Card Customer Care

- Standard Chartered Credit Card Customer Care

- Canara Bank Credit Card Customer Care

- HSBC Credit Card Customer Care

- Indian Bank Credit Card Customer Care

- Bank of Baroda Credit Card Customer Care

- Bank of India Credit Card Customer Care

- Union Bank of India Credit Card Customer Care

Credit Card Bill Payment

- Credit Card Bill Payment

- SBI Credit Card Bill Payment

- HDFC Credit Card Bill Payment

- Federal Bank Credit Card Bill Payment

- Axis Bank Credit Card Bill Payment

- IndusInd Credit Card Bill Payment

- Kotak Credit Card Bill Payment

- Standard Chartered Credit Card Bill Payment

- RBL Bank Credit Card Bill Payment

- HSBC Credit Card Bill Payment

- PNB Credit Card Bill Payment

- Canara Bank Credit Card Bill Payment

- Bank of Baroda Credit Card Bill Payment

- Bank of India Credit Card Bill Payment

- Union Bank Credit Card Bill Payment

Credit Card Eligibility

- Credit Card Eligibility

- SBI Credit Card Eligibility

- HDFC Credit Card Eligibility

- Federal Bank Credit Card Eligibility

- Axis Bank Credit Card Eligibility

- Yes Bank Credit Card Eligibility

- IndusInd Bank Credit Card Eligibility

- HSBC Credit Card Eligibility

- Kotak Credit Card Eligibility

- Canara Bank Credit Card Eligibility

- Standard Chartered Credit Card Eligibility

- RBL Bank Credit Card Eligibility

- Bank of Baroda Credit Card Eligibility

- Union Bank Credit Card Eligibility

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.